41+ debt-to-income ratio mortgage calculator

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Ad Compare Mortgage Options Calculate Payments.

250 Money Savings Tips To Save An Extra 500 Each Month

Compare Mortgage Options Get Quotes.

. Low Credit No Problem. For instance if you pay 2000 a month for a mortgage 300 a month for an auto loan and 700 a month for your credit card balance. Research Fund Options That Fits Your Investment Strategy.

Ad Calculate Your Payment with 0 Down. Web The amount of money you spend upfront to purchase a home. Web Whats an Ideal Debt-to-Income Ratio for a Mortgage.

A DTI of 43 is typically the highest. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt. Scroll down the page for more. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability.

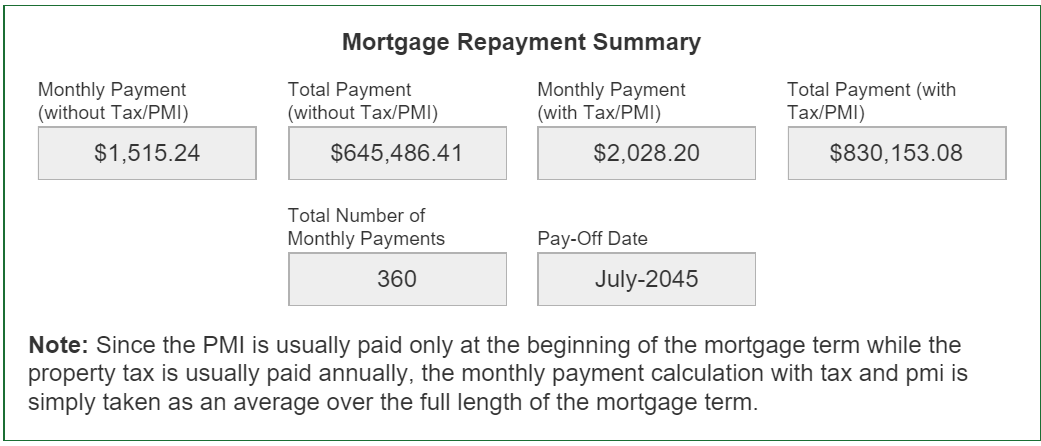

If youre applying for a bigger loan or a loan with strict lenders however they may. Web Your debt to income ratio or debt ratio is the percentage of income that goes to pay housing and debts - and it. On a 300000 fixed-rate 30-year mortgage the average rate is 641 as of Thursday if your credit score is in the 760-to-850 range according to.

Web The debt-to-income formula is simple. This includes cumulative debt payments so think credit card. Web A debt-to-income ratio of 20 means that 20 of your income is going toward debt payments.

Monthly mortgage or rent payment minimum credit. Then multiply that number. Web For illustration only.

Ad Compare Mortgage Options Calculate Payments. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web 36 to 41.

Web Your debt-to-income ratio matters when buying a house. Web How to calculate debt-to-income ratio. Most home loans require a down payment of at least 3.

Apply Now With Quicken Loans. Web Your debt-to-income ratio or DTI is a percentage that tells lenders how much money you spend on monthly debt payments versus how much money you have coming. Web To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments student loan payments car payments minimum.

Add up all of your monthly debts. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Apply Now With Quicken Loans.

Get Started Now With Quicken Loans. Ad Learn if You Qualify in 2 Minutes or Less. Get Started Now With Quicken Loans.

Total monthly debt payments divided by total monthly gross income before taxes and other deductions. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. But with a bi-weekly.

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. It allows lenders to determine the likelihood that you can afford to repay a loan. Your total debt divided by your gross monthly income.

Web Heres a simple two-step formula for calculating your DTI ratio. These payments may include. Ad Calculate Your Payment with 0 Down.

For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000. Compare Mortgage Options Get Quotes. Assume your gross monthly.

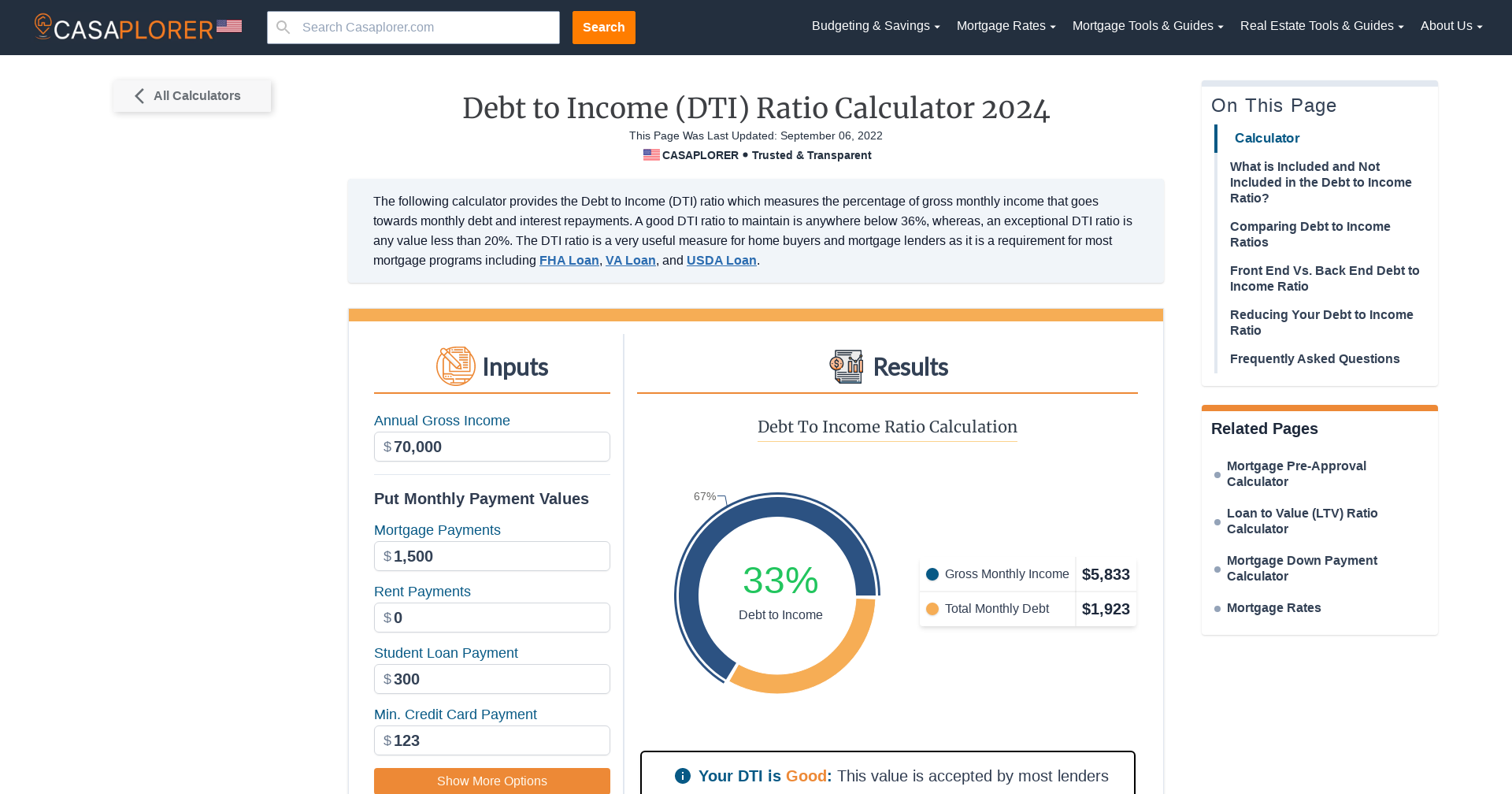

Get Started In Your Future. Your DTI or debt-to-income ratio is based on two numbers. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. To get the back-end ratio add up your other debts along with your housing expenses. Web Debt-to-income ratio DTI is the amount of your total monthly debt payments divided by how much money you make a month.

Web Sum of Monthly Debts Pre-Tax Monthly Income 100 Your DTI For example say your monthly debt expenses equal 3000. Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value.

- SmartAsset Mortgage lenders typically look for debt-to-income ratios of 36 or lower. Debt-to-income ratios between 36 and 41 suggest manageable debt levels. Web Your front-end or household ratio would be 1800 7000 026 or 26.

Use Funds for Anything.

List Of Top Personal Loan Providers In Waluj Midc Best Personal Loans Online Justdial

Debt To Income Ratio Calculator Interactive Hauseit Nyc

Iwxfngwp0cqb2m

Debt To Income Ratio Calculator Nerdwallet

Debt To Income Ratio Calculator Interactive Hauseit Nyc

Tutorial Mortgage Calculator

House Poor How To Save Money On Your Home After The Closing

Calculate Your Grade On Suze S How Am I Doing Financially Show Pdf

First Merchants Debt To Income Ratio Calculator Free Mortgage Calculator First Merchants Bank

Debt To Income Ratio Calculator The Motley Fool Uk

Debt To Income Dti Ratio Calculator 2023 Casaplorer

Calculate Your Grade On Suze S How Am I Doing Financially Show Pdf

Debt To Income Ratio Crb Kenya

Rc5v0wed3oeqem

Mortgage Hacks To Painlessly Pay Your Mortgage Off Early

Debt To Income Ratio Calculator Interactive Hauseit Nyc

Debt To Income Ratio Calculator Lowermybills